Maximizing year-end planning: Section 179 for physicians – examples and benefits

Section 179 is an important step in your year-end planning journey.

© Jemastock - stock.adobe.com

As the year draws to a close, it is a pivotal time for physicians to begin financial planning for 2024. One way to kick-start planning is by taking advantage of Section 179.

Whether you are looking to invest in new equipment or enhance your practice’s overall financial health, understanding Section 179 is an important step in your year-end planning journey.

Let’s delve into the intricacies of Section 179, examine real-world examples, and uncover the tangible benefits it can offer medical professionals.

What Is Section 179?

Section 179 refers to the Internal Revenue Service (IRS) code that allows business taxpayers to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the property to be depreciated over time. Section 179 is designed to encourage small and medium-sized businesses to invest in capital assets by providing an upfront tax incentive. It allows businesses to deduct the cost of eligible assets in the year they are placed into service.

How does Section 179 work?

Qualifying property typically includes tangible, depreciable assets such as equipment, technology, furniture, and off-the-shelf software. Section 179 addresses assets that will retain their value after they are put into use. To claim the Section 179 deduction, the property must be used for business purposes for more than 50 percent of the time. Businesses must make an election on their tax return and specify the property for which the deduction is being claimed. Businesses structured as pass-through entities, such as partnerships and corporations, can pass the Section 179 deduction through to their owners who can then claim it on their individual tax returns.

What are the Section 179 limits?

In the 2023 tax year, the maximum deduction under Section 179 is $1,160,000.A business can combine multiple expenses to reach that total, but there is an overall limit to the eligible equipment you can buy and still receive a deduction. Your Section 179 deduction is limited to your business’s net income for the year – and you cannot use the Section 179 deduction to create a loss. If you have a net income of $100,000 before taking the Section 179 deduction and you purchase $125,000 of capital equipment, your deduction will be limited to $100,000.You can opt to take regular depreciation on the remaining assets, or you can carry the remaining $25,000 forward to next year as long as your net income allows it.

Does Section 179 cover real estate?

According to the IRS, Section 179 does not cover real estate purchases. If you purchase a new space for your practice, you will likely need to rely on depreciation to receive a tax benefit from that purchase.That said, there are a few special types of property that may qualify as a Section 179 expense including:

- Roofs

- Heating, Ventilation, and Air Conditioning

- Security Systems

- Fire alarm/protection systems

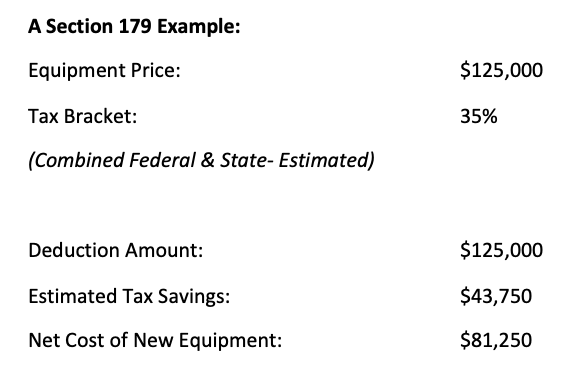

Courtesy of Henry Schein Financial Services

Can I finance equipment purchases and still benefit from Section 179?

Equipment and technology purchases can be financed while also taking advantage of Section 179. It is important to carefully consider the terms and options available to ensure they align with your practice’s specific needs. Henry Schein Financial Services is one option that offers financing to help physicians acquire new equipment and technology before the end of this year, so your practice can benefit from the Section 179 deduction.

For instance, through Henry Schein Financial Services, a 6-month deferral is available before making any payments. This allows your practice to generate revenue using your new equipment, and receive your Section 179 benefit before even making the first payment.

Using the example above, based on current rates for a five-year loan, the Section 179 tax savings will cover the first 16 payments. Try not to let the interest rate environment prevent you from making necessary investments into your business.

Natalie Westfall is Vice President and General Manager of Henry Schein Financial Services. For a complimentary consultation and to learn more about Section 179, please contact Henry Schein Financial Services online, call 1-877-776-7286, or email hsfs@henryschein.com. As always, it is important to consult your own financial and tax advisors to discuss your individual circumstances.

Asset Protection and Financial Planning

December 6th 2021Asset protection attorney and regular Physicians Practice contributor Ike Devji and Anthony Williams, an investment advisor representative and the founder and president of Mosaic Financial Associates, discuss the impact of COVID-19 on high-earner assets and financial planning, impending tax changes, common asset protection and wealth preservation mistakes high earners make, and more.

Real Estate Transactions for Physician Practice Owners

April 26th 2021Physicians Practice® spoke with Colin Carr, CEO of Carr Realty, to find out what physicians and practice owners should know about real estate trends in early 2021 and the best practices in making commercial healthcare real estate purchases.

Is your practice ready for the Trump tariffs?

April 7th 2025Tariffs are set to drive up costs across industries — including health care — impacting everything from medical supplies to retirement accounts. Take a look at the ripple effects on medical practices and some proactive strategies for physicians to stay one step ahead.