Law & Malpractice

Latest News

Latest Videos

CME Content

More News

Learn how the Hospital-Acquired Conditions Reduction Program works and how it can impact your facility's revenue.

Not all trusts are equal, find out what kind you need.

Implications of the new law.

Top tips and HIPAA implications.

There are plenty of benefits to remote or hybrid teams, but there are also communication and security issues that must be kept in mind.

Here’s how to make sure your practice is in compliance with Stark regulation clarifications taking effect January 1st, 2022.

Complaints against physicians can have major consequences.

Appreciating how to avoid an enforcement action under the Right of Access Initiative, as well as mitigating cyberattacks with HHS’s cybersecurity resource website.

Keep on eye on these areas to avoid major financial and professional consequences.

These actions can ensure your practice is protected going into the new year.

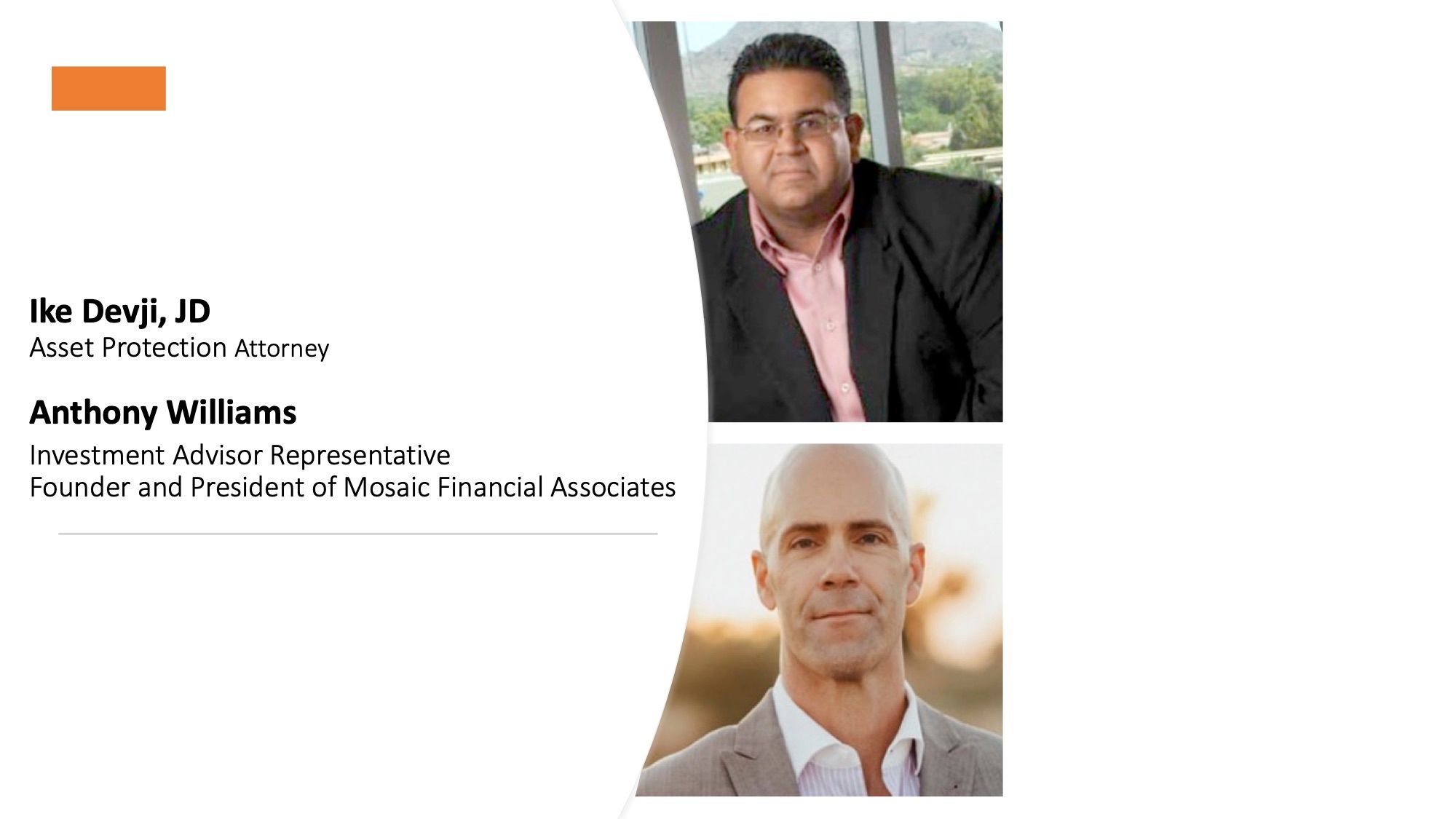

Asset protection attorney and regular Physicians Practice contributor Ike Devji and Anthony Williams, an investment advisor representative and the founder and president of Mosaic Financial Associates, discuss the impact of COVID-19 on high-earner assets and financial planning, impending tax changes, common asset protection and wealth preservation mistakes high earners make, and more.

All the details you need before the act goes into effect on Jan. 1.

Ready or not, office holiday parties are back this year. These are some of the risks that practice owners and leaders should manage to help ensure a stress-free holiday and a positive transition to the New Year.

Emergency funds, retirement accounts, and more.

Physicians Practice® spoke with Kristina Hutson, a product line developer at Availity, about surprise billing events in independent healthcare practices and what owners and administrators can do to reduce the likelihood of their occurrence.

On December 2, 2020, CMS published new provisions and exemptions related to the Stark Law (85 Fed. Reg. 77492) and HHS-OIG published new provisions and safe harbors related to the Anti-Kickback Statute (AKS) (85 Fed. Reg. 77684.

Research shows medical offices and clinics are vulnerable to inadvertent spread.

The healthcare transparency act was recently updated. Here’s what it’s about and its potential consequences.

Code accurately with the appropriate documentation to substantiate medical necessity.

Basic rules to be aware of and some specific tax plans that require extreme caution and due diligence.

Two experts sit down and talk about asset protection.

What doctors must understand about their insurance and why not all polices are equal.

How to talk with patients about vaccine concerns.

By making strategic yet affordable investments and undertaking specific basic measures, smaller practices can make great strides to strengthen their defenses.

With the impending reporting period upon providers, this article highlights the current status of Reporting Period 1 and relays some recent enforcement actions.