Investment is a different profession than medicine, so please physicians, get help on getting the greatest returns, especially when it comes to real estate.

Investment is a different profession than medicine, so please physicians, get help on getting the greatest returns, especially when it comes to real estate.

Physicians, it is time to reevaluate holding cash for your retirement. Here’s why.

Investing - much like the decisions in your medical career - is about sometime taking risks. But you also should know what risk pays and what risk does not.

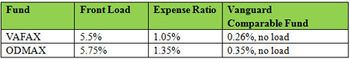

A little change in a physician's portfolio, utilizing the predictive power of expense ratios, can make a big difference in his future wealth.

A one-year delay in the proposed Medicare SGR payment cut is one of three wins of the fiscal cliff deal reached in Washington, D.C., for physicians.

The end of the Bush-era tax cuts is likely on the horizon. Here's what it means for physicians and how they can begin preparing today.

My advice for very successful doctors who are thinking about investing in real estate: Your profession is medicine, not real estate.

There are three lessons all physicians can learn from a story a doctor’s wife recently shared regarding a life-changing incident.

It's a major conflict of interest when the financial advisor is also receiving kickbacks from mutual fund companies and insurance accompanies.

Physicians working on their own or in a small practice are alone responsible for their financial well-being in retirement, so a 401(k) is a good idea.

The entire U.S. healthcare system is caught between a budgetary rock and an obligatory hard place.

You may not believe it, but the term “financial advisor” is a free title. Unlike “physician,” there is no legal requirement, nor educational qualification.

Investment advisor Michael Zhuang shares his experiences from working with physicians.

Generally speaking, physicians make good money while in practice. Many of them are in the top tax brackets. Upon retirement, however, their earned income often drops to zero. If they can defer some of their compensation to the future, they can effectively move money from the top tax brackets to lower tax brackets.

There are many tax law changes that have come into effect. I asked the tax specialist in my wealth management network to give me a list of tax law changes in 2010.

Published: August 17th 2013 | Updated:

Published: April 18th 2014 | Updated:

Published: June 19th 2014 | Updated:

Published: February 1st 2014 | Updated:

Published: February 25th 2011 | Updated:

Published: February 24th 2011 | Updated: