Physicians are now potential targets for fraud and abuse inquiries. Here are a few simple things your practice can do to protect itself from unwanted litigation.

Physicians are now potential targets for fraud and abuse inquiries. Here are a few simple things your practice can do to protect itself from unwanted litigation.

Payers know that correctly writing down every patient encounter is difficult for physicians, if not impossible. Therefore, exploiting this is easy for them.

When admitting patients to the hospital, knowing Medicare rules and making use of diligent charting can make all the difference.

A little preparation will go a long way toward helping medical practices pass meaningful use audits.

There are three main changes to HIPAA coming Sept. 23, 2013, that medical practices need to know about. Here's what they are and what you should do.

This week we take a look at this growing area of exposure for medical practices and some basic credentialing-compliance best practices.

A recent court case illustrates why physicians need to be vigilant in reporting incorrect claim submissions every time, all the time.

When it comes to audits, "payers are sneaky and relentless, because they have everything to gain and nothing to lose," notes consultant Angela Miller.

Rob Anthony of CMS provides some clarity to physicians and medical practices on the upcoming meaningful use audits.

Attesting for meaningful use? There’s a 5 to 10 percent chance you’ll be audited before you see your first big check.

Here are six steps your medical practice can take to avoid being the target of a tax audit or a malpractice suit.

It's tax season and with the IRS notifying more physicians of tax audits, there are some steps you can take today to avoid being included in this group.

A brief guide for physician practices, including tips on protecting yourself against RAC audits.

In this podcast, consultant Ronald Sterling notes the critical steps every practice should take to verify the clinical content in its EHR.

Coding expert Mary Pat Whaley offers four key tips to minimize the chances of a RAC audit at your medical practice.

Some of the key items outlined in the Physician Payment Sunshine Act final rule and how physicians can prepare for enforcement.

Healthcare providers nationwide are taking issue with payers conducting pay-then-pull-back audits and delayed payments for covered treatments.

Attorney Rachel Rose provides some details and frequent issues for physicians regarding Recovery Audit Contractor audits.

From increasing HIPAA training among staff to stepping up billing compliance efforts, here are key action steps to consider making in the New Year.

Want to avoid a larger audit at your medical practice? Self-auditing is a great first step for you and your physicians.

A new type of audit may be headed to your medical practice. Make sure you are ready.

Here's a breakdown of the federal government's HIPAA audit procedures and how your office can be prepared.

In light of the fact that these RAC audits are a real probability, medical practices should be aware of issues that may arise in an audit of E&M codes.

Here is how providers and coders at your medical practice can select the right E&M medical codes the first time.

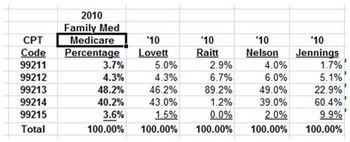

Don't let your practice be caught up in Medicare's recovery program. It's a simple matter to examine your own coding patterns and compare them to national utilization data.