I have seen physicians make many expensive mistakes during the retirement planning process. Here are a few of the most common.

I have seen physicians make many expensive mistakes during the retirement planning process. Here are a few of the most common.

Being able to decide how many days you want to see patients is great for raising kids. But, it can cramp the family budget. How do you balance both?

CMS is proposing to withdraw the Sunshine Act exemption for payments made to healthcare providers who serve as speakers for accredited CME programs.

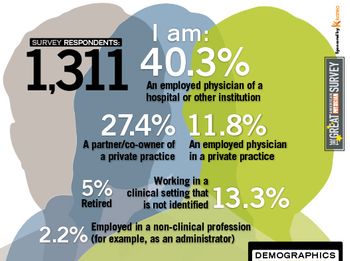

Get unique insight into the personal and professional lives of physicians through the results of the 2014 Great American Physician Survey, Sponsored by Kareo.

Many physician families that have done estate planning have a "living trust" in their documents. Here's how it works and what it is useful for.

Many doctors are working on selling their practices. Here are four common legal areas that could pose problems.

Finding the right balance between saving and spending differs for everyone, but there is one good rule of thumb to follow.

An attempt by CMS to repeal a Sunshine Act exemption for payments made to speakers at accredited CME events has physician associations hopping mad.

A closer look at how retirement plans differ, how they work, and how to determine what is right for your practice.

Becoming a guarantor for medical student loans can place undue strains upon family income and assets. Develop a plan first, before committing to help a loved one.

Determining where and how to invest is often a challenging process. Here are some tips for physicians.

Are you doing all you can to ensure financial stability during retirement? Here, a financial planner shares his key advice.

Many physicians travel and volunteer their services. However, if you plan to deduct your volunteer-related expenses, there are rules that you should know about.

Many doctors experience a large gap between what they typically earn and their disability benefits. Here are five strategies to better protect yourself.

One of the biggest challenges facing physicians in obtaining asset protection is selecting qualified counsel. Make sure you do your due diligence.

Asset protection is an increasing concern for many doctors. Not understanding that a large IRA inherited from a parent is vulnerable could be a tragic error.

Understanding the terms and provisions within your disability policy will help you determine if you have the right coverage for your needs.

Asset protection is a vital part of every physician's essential legal and financial plan; unfortunately, most doctors don't know how to pick the right legal help.

Making smart financial decisions differs greatly from making smart medical and treatment decisions.

Despite higher than average incomes and education one asset that physicians surprisingly often fail to protect is their credit.

During the assessment phase of financial planning, the physician's financial planner will provide recommendations that may lead to a more cohesive and thought out structure.

Offshore or international asset protection trusts can be safe, predictable, and effective, under the right conditions for physicians.

The objective phase of financial planning for physicians requires addressing specific financial topics and assessing important documents.

Investment is a different profession than medicine, so please physicians, get help on getting the greatest returns, especially when it comes to real estate.

Despite the wide range of risk and planning issues for physicians to consider, a certain core group of tools is almost universally applicable to all doctors.