In this podcast, consultant Betsy Nicoletti explains the changes in CMS’ 2010 final physician fee schedule that could affect your practice.

In this podcast, consultant Betsy Nicoletti explains the changes in CMS’ 2010 final physician fee schedule that could affect your practice.

Want to know how to boost your scores on those seemingly arbitrary online physician-rating sites? The sites aren’t going away, so you’ll need to know how to make the best of them.

Going into business with friends may seem like a great idea. Physicians are often asked to help fund a startup business. But these ventures often disappoint, and when they do, relationships can be ruined.

Evaluating a partnership offer has been complicated by the recession. Is ownership still worth it?

Our 2009 Physician Compensation Survey reveals general dissatisfaction - and wide divisions between specialists and primary care docs. Get all the details and advice on ways to earn what you deserve, despite the downward trend.

An unnecessary service charge here, a bloated maintenance contract there - you may be only dimly aware of how these small “nickel and dime” charges add up to big bucks.

Few administrators experience daily upheavals in their practices, but most are presented with a major transition at some point during their career. Are you ready?

Practice managers who are amicably leaving, be it for retirement or another opportunity, are often tasked with finding and training their own successor. Here’s some advice on this peculiar last act.

What are the secrets of success in an ever changing practice-management climate? Veteran administrators dish.

Remember when real estate was a can’t-miss investment? Those days may be over, but your home is still an important piece of your portfolio.

You’ve got questions - lots of ’em. And we’ve got the answers. We compiled some of the most common practice management questions we hear - from collections issues to dealing with staff problems and so much more - in one place, and got answers from some of the top experts in the business.

Times are tough, and layoffs may be unavoidable. If you must do it, here’s how to do it right - while protecting your practice from litigation.

The best measure of physician productivity is the “relative value unit,” or RVU. But a physician trying to figure out how much she’ll be paid under this system doesn’t know where to start, or even what an RVU is. Here’s help.

With more of today's young doctors starting their careers deeply in debt for medical school, there are ways to dig out and come out on top.

In many practices, partner conflict is as common as nasal infections. It may be easy to “let it go,” but that can lead to unprofessional conduct. Here’s how to diffuse disagreements and preempt disputes.

The EHR stimulus has physicians and vendors alike buzzing. But are they asking the right questions, or just looking for a handout?

A little price comparison can help you save big bucks on common goods and services.

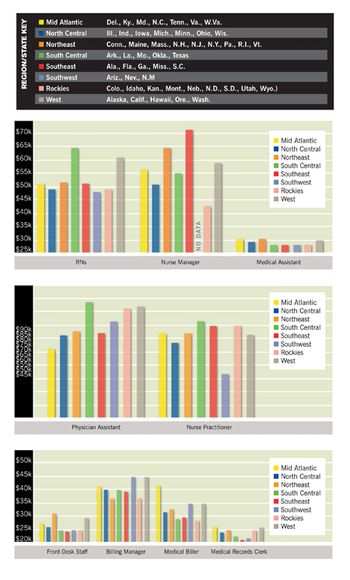

Deciding how much to dole out to support staff can be tricky, especially in a difficult economy. But our survey of more than 1,000 practices nationwide will help guide you.

With prices low, it may seem like a great time to buy your office space. Be wary; the advantages to ownership, while real, are balanced with disadvantages and risk. Make sure your eyes are open.

Safeway, a grocery chain with 200,000 employees in 22 states, claims that it held its employee healthcare costs flat for three years running. How, you might ask? Read on for more about this radical program.

The biggest blunders of affluent investors - and how to avoid them.

Ah, those advice-seeking loved ones: You gotta love ’em, but they can be a major a nuisance - and even a legal risk. Here’s how to draw the line and still get invited for dinner.

Summer vacation season is upon us. Here’s how to keep your practice running when your skeleton crew asks for time off.

Are medical practices more or less likely today to offer patients a payment plan to help them cover their increasing out-of-pocket costs? Such doctor-arranged payment plans would have significant advantages for so-called “self-pay” patients, many of whom charge out-of-pocket costs on high-interest credit cards.

I just got a refund request from a payer. It’s for close to $1,000 for a patient we saw from 2004 to 2007. The payer now says the patient wasn’t eligible then. We checked, and it turns out the patient actually was on a Medicaid managed care plan and was not with the payer we billed. Still, Medicaid won’t consider claims from 2004. I just do not know what my options are. Are there any regulations to prevent this?