From inadequate cyber insurance to poor RAC audit coverage, many physicians are purchasing policies that could result in big losses down the line.

From inadequate cyber insurance to poor RAC audit coverage, many physicians are purchasing policies that could result in big losses down the line.

Here's what the requirement to be "commercially reasonable" means under the Stark Law and Anti-kickback Statute and what physicians need to know.

Leasing your medical practice to a hospital? You may want to consider these 15 contract provisions to ensure your practice is protected for the future.

In light of continuing Medicare fraud, it is vital to review your coding and billing procedures. Prevention is key to avoiding expensive take-backs.

Here are five things that physicians can do to mitigate the risk of not only frivolous suits, but legitimate ones.

Misclassifying an employee as an independent contractor has serious ramifications for medical practices. Make sure you know the distinction.

In the new value-based reimbursement environment, co-management arrangements can align the interests of physicians and hospitals. Here's what you need to know.

CMS is proposing to withdraw the Sunshine Act exemption for payments made to healthcare providers who serve as speakers for accredited CME programs.

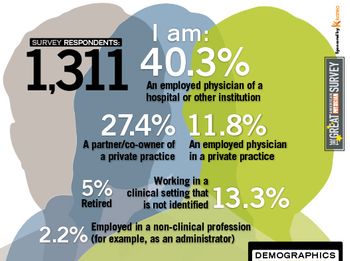

Get unique insight into the personal and professional lives of physicians through the results of the 2014 Great American Physician Survey, Sponsored by Kareo.

The chief patient safety officer at medical malpractice insurer The Doctors Company identifies six common communication missteps physicians make.

Physicians face a wide variety of exposures beyond medical malpractice claims including both labor and tax claims for misclassified contractors.

Understanding the principles of leasing medical office space will enable practices to negotiate a lower-cost and equitable leasing agreement.

Not only is it important that physicians report payments via the Sunshine Act, but also verify they match the amount the gift-giver is also reporting to CMS.

The deadline for reviewing records and reporting compliance with the Sunshine Act is Aug. 27. There are several tools to make that task easier for physicians.

Many doctors are working on selling their practices. Here are four common legal areas that could pose problems.

Smart use of your patient portal can not only help physicians meet meaningful use rules, but also foster better patient interactions.

An attempt by CMS to repeal a Sunshine Act exemption for payments made to speakers at accredited CME events has physician associations hopping mad.

The gap between having an EHR and meeting meaningful use is wide. Here are three tips to narrow the divide.

Anyone involved with protected health information at your medical practice can be the one who gets you fined for a HIPAA violation. So due diligence is a must.

Recording family health history may be one of the easier meaningful-use objectives - because you likely already do it and due to an interesting loophole.

The use of drugs and alcohol by physicians is a well-known public health risk, but is California's proposal to randomly drug and alcohol test physicians the answer?

Becoming a guarantor for medical student loans can place undue strains upon family income and assets. Develop a plan first, before committing to help a loved one.

More than 8 million patients have signed up for insurance due to the ACA, according to HHS, but where are all of them?

Physicians have a multitude of options when structuring ACOs. Make sure you understand all the legal requirements before committing your practice.

It's no secret that the United States is facing a serious physician shortage. But how far should we go to ensure adequate access to patient care?